Medical Debt…Another Risk for Low-Wage Essential Health Care Workers

Posted in Blog Research Briefs What's New | Tagged essentialworkers, home health aides, medical debt

Relief from Racial Disparities in Medical Debt and Medical Financial Insecurity Add to the Reasons to Restructure Low-Wage “Essential” Health Care Jobs

March 4, 2022

Carol B. Davis, PhD, MBA

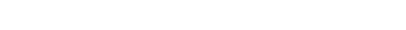

In October 2021, Andre Perry and a team at The Brookings Institution described the racial implications of medical debt with special attention to the disproportionate burden of medical debt that ensnares and weighs Black families. Twenty-seven percent of Black families hold medical debt, compared to 17% of non-Black families, according to the study (Brookings, Figure 2). In the Brookings analysis, the median amount of medical debt held by families with medical debt was $2,000, but the average was approximately $20,500.

Perry et al’s findings are compelling and startling. Uninsured families are more likely to hold medical debt, but a sizable share of the families with medical debt have at least some insurance. Black households with insurance are almost equally likely to have medical debt as white families who are not insured (Brookings, Figure 3), signaling that other factors are at play.

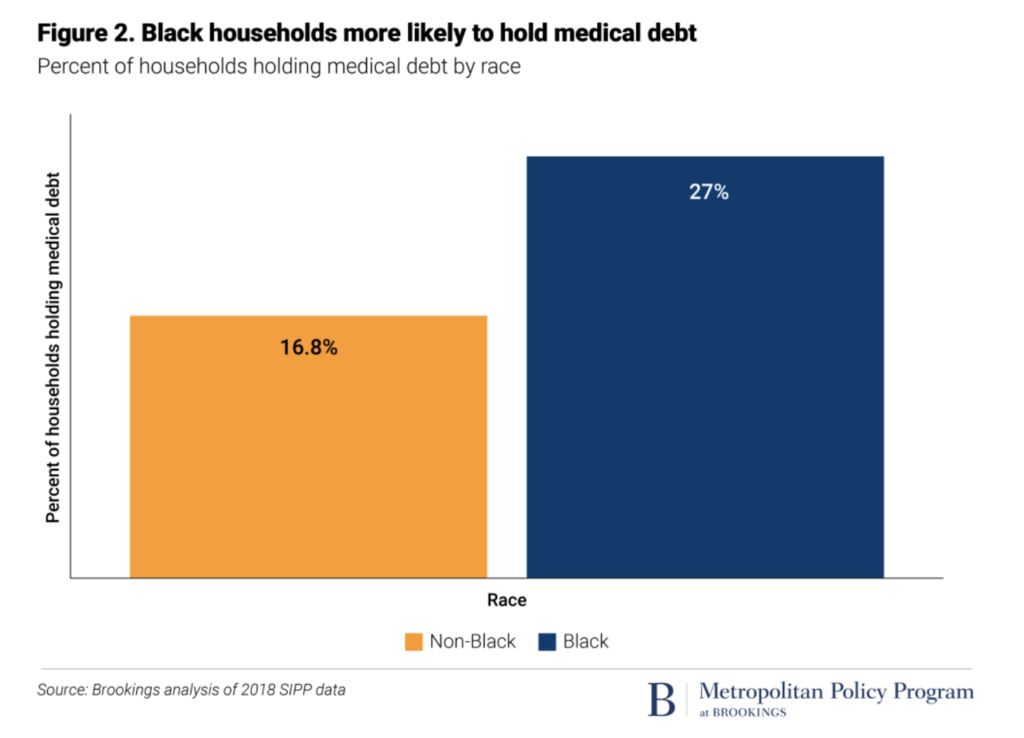

Even more than insurance status, the burden of medical debt is associated with zero or negative net worth. A concerning 80% of medical debt is held by families with zero or negative net worth (Brookings, Figure 1). As noted in Perry et al., medical debt is a function of wealth. Data on the distribution of wealth and of income, segmented by race, help illustrate the underlying disparity that compounds the financial risk of medical care making Black families more vulnerable to medical debt and, more broadly, economic insecurity overall.

Analysis of recent data from the St. Louis Federal Reserve and by our researchers at the Health Care Financing Initiative (HCFI) of Georgetown University McCourt School help quantify the extent of the wealth and income disparity underlying the disparity in accruing medical debt.

At the Federal Reserve Bank of St. Louis, researchers Hernandez-Kent and Ricketts clearly showed the stark disparity in household wealth, with the share of Black families experiencing negative net worth in 2019 double that of white families. Our team at HCFI looked at census data to find the median income for Black families at $46,600 compared to $77,000 for median white families. For families with modest or negative net worth, even small expenses by medical care standards can be difficult to pay and can create barriers to future care or medical financial security.

At the start of the COVID-19 pandemic, policy makers at the federal and state levels defined many jobs as “essential” for the continuity of America’s economic life and social welfare. A cruel irony is that a substantial share of essential workers upon whom we rely for that day-to-day continuity, including basic health and personal care for our loved ones, are themselves low-wage, uninsured or underinsured, and highly vulnerable to insecurity in their medical financial lives. For example, the U.S. Bureau of Labor Statistics reports median annual earnings for home health and personal aides in 2020 was $27,100. The median nursing assistant earned $30,850 that year. As our country transitions from Black History February to Women’s History Month in March, it is timely to point out the demographics of the essential workers in health care, specifically in home-based care: 90% female, 47% people of color, and 30% foreign-born.

I agree with the esteemed experts at Brookings when they call for a restructuring of essential jobs. Such a shift is very much in order if we are to achieve lofty goals such as equity and economic justice for our essential frontline workers. Protecting their medical financial security with an eye to a livable income, convenient access to affordable medical care, and protection against impoverishing medical care costs—in other words, providing an opportunity to build at least a modest financial cushion—would be critical components in a virtuous policy package that could reduce the structural economic and health disparities that exist in our society.

#essentialworkers. #medicaldebt #wealthdisparities #womenshistorymonth

Carol B. Davis, PhD, MBA is an Assistant Research Professor at the McCourt School of Public Policy at Georgetown University. You can follow Dr. Davis (@cbarnettdavis) and the HCFI team at (@GUHealthFinance) on Twitter.

References: